Imran Khan unlikely to walk free soon, government may last only 18 more months: Fitch

1. In unlikely event that govt is replaced, most likely alternative is a technocratic administration, says BMI

- BMI says risks to their growth outlook heavily weighted to downside.

- Forecasts economic growth to accelerate to 3.2% in FY2024-25.

- C/A deficit may widen from 0.8% of GDP in FY24 to 1% in this fiscal.

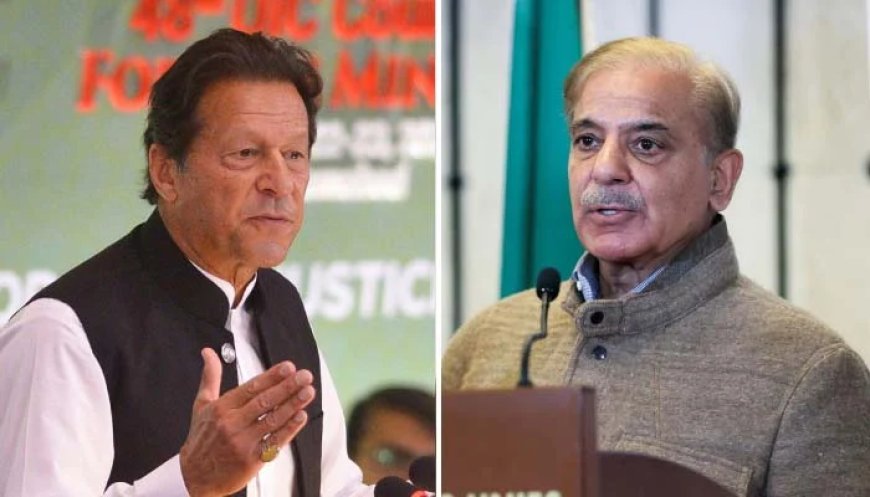

ISLAMABAD: BMI, a Fitch Solutions company, has forecast that Pakistan Tehreek-e-Insaf (PTI) founder Imran Khan is unlikely to walk free anytime soon, while Prime Minister Shehbaz Sharif-led coalition government may prove a house of cards in the next one-and-a-half years amid economic uncertainties.

“Despite several successful legal appeals, opposition leader Imran Khan will remain imprisoned for the foreseeable future,” predicted BMI, in its Pakistan Country Risk Report for the fourth quarter of the calendar year 2024.

The risk evaluation company also painted a dire scenario for the ruling alliance, which is considering banning PTI as a political party over its alleged anti-state activities following a favourable verdict by the country’s top court in its reserved seats case.

“We expect that the Pakistan Muslim League-Nawaz (PML-N)-led government will remain in power over the coming 18 months and will succeed in pushing through with International Monetary Fund (IMF) mandated fiscal reforms.”

Going a step further, the Fitch Solutions company also appears to have figured out who or what will fill the vacuum created by the anticipated ouster of the incumbent government.

“In the unlikely event that the government is replaced, the most likely alternative is a technocratic administration rather than fresh elections,” the BMI prophesied.

Touching on the threats, the report says there is a greater likelihood of negative events or factors affecting future growth than positive ones. This means the odds of setbacks, slowdowns, or other adverse consequences are greater than the chances of improvements.

“The risks to our growth outlook are heavily weighted to the downside. Pakistan’s economy remains very fragile in the face of external shocks.

“Given that 40% of Pakistanis work in agriculture, another flood or drought would pose a significant risk to the economy. The country’s fragile political situation could also derail the recovery,” the risk evaluator said.

It said while parties were successful in creating a new coalition government following the February election, the strong electoral performance of independent candidates was backed by jailed PTI leader Imran Khan.

"Another round of protests in urban areas could disrupt economic activity,” the Fitch wing warned.

On the economic side, the BMI doesn’t see an imminent crisis haunting Pakistan but warns that a lot depends on the political stability and climatic conditions conducive to agriculture.

“As we had predicted, economic activity in Pakistan was stronger than most analysts had expected in the fiscal year 2023-24 (July 2023-June 2024).

“Economic growth in Pakistan will accelerate from 2.4% in the fiscal year 2023-24 to 3.2% in the fiscal year 2024-25, driven by monetary easing, improved agricultural output and slowing inflation,” the Fitch firm said.

In its forecast regarding one of the most important economic indicators, it said, “We think that Pakistan’s current account deficit will remain small but will widen from 0.8% of GDP in fiscal year 2023-24 to 1.0% of GDP in 2024-25.”

It said easing inflation would provide the State Bank of Pakistan (SBP) with the space to cut its key policy rate from 22% to 16% in 2024.

“We expect that policymakers at the SBP will continue to loosen policy over the longer term, to 14% by the end of 2025.

“The key risk to this forecast is towards faster-than-expected inflation, which would cause policymakers to slow their easing cycle,” the Fitch firm added.